Imposing tariffs on agricultural products imported from the United States has little impact on China.

-Interview with Han Jun, Deputy Director of the Central Agricultural Office and Vice Minister of Agriculture and Rural Affairs.

In view of the hot issues related to agricultural products in Sino-US economic and trade frictions, the reporter recently interviewed Han Jun, deputy director of the Central Agricultural Office and vice minister of agriculture and rural affairs.

China’s agricultural trade has a huge volume and a broad market.

Reporter: Please tell us about the overall situation of Sino-US agricultural trade in recent years. How do you evaluate the development of Sino-US agricultural trade?

Han Jun: Agricultural products trade plays an important role in Sino-US economic and trade relations. China is the world’s largest importer of agricultural products, and the United States is the world’s largest exporter of agricultural products. Strengthening agricultural trade cooperation between China and the United States is conducive to promoting the agricultural development of the two countries.

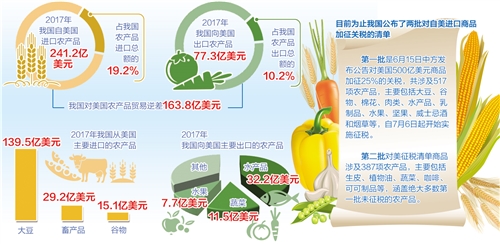

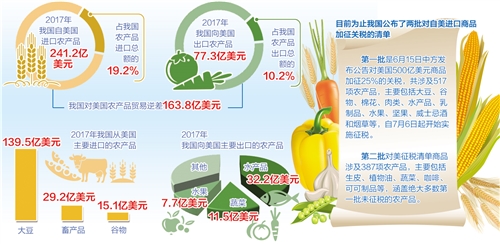

American agriculture has a high level of modernization and strong competitiveness. Expanding the export of agricultural products to China has always been the focus of the United States to expand overseas markets. Agriculture has always been a core issue in Sino-US economic and trade consultations. In 2017, China imported 24.12 billion US dollars of agricultural products from the United States, accounting for 19.2% of China’s total agricultural products imports; Exports of agricultural products to the United States amounted to $7.73 billion, accounting for 10.2% of China’s total agricultural exports; China’s agricultural trade deficit with the United States reached $16.38 billion.

China and the United States have different endowments of agricultural resources, and the trade of agricultural products is highly complementary. The advantages of land-intensive agricultural products in the United States are outstanding, while the advantages of labor-intensive agricultural products in China are obvious. In 2017, China mainly imported soybeans (US$ 13.95 billion), livestock products (US$ 2.92 billion) and cereals (US$ 1.51 billion) from the United States; China’s agricultural products exported to the United States are mainly aquatic products ($3.22 billion), vegetables ($1.15 billion) and fruits ($770 million).

China will have a huge demand for agricultural products imports in the future. It is China’s established policy to actively expand agricultural products imports, which is a big cake for global agricultural products exporting countries. We hope that Sino-US agricultural trade can develop healthily, and American farmers can share the cake of China’s expansion of agricultural products imports. The United States ignores the consensus reached by both sides and constantly escalates trade frictions. We firmly oppose it. China is unwilling to engage in a trade war with the United States, but in the face of what the United States has done, China has to introduce necessary countermeasures. If a trade war breaks out between China and the United States, many countries are willing and fully capable of replacing the market share of American agricultural products in China. I have noticed that the American agricultural community is deeply worried about this and hopes to resolve the trade differences between the two countries through negotiations.

China is fully capable of coping with the gap in the reduction of soybean imports in the United States.

Reporter: In response to the economic and trade frictions provoked by the United States, China has taken different measures against some agricultural products imported from the United States. What is the specific situation? Why do you take these measures?

Han Jun: Under the strong leadership of the CPC Central Committee, we resolutely safeguard the core interests of the country, rationally handle Sino-US economic and trade issues, and have to take necessary countermeasures in the agricultural field. So far, China has published two lists of tariffs on goods imported from the United States. Regarding the first batch, China issued an announcement to impose a 25% tariff on US$ 50 billion goods, including US$ 34 billion goods including agricultural products, which will be taxed from July 6, 2018, and the remaining US$ 16 billion goods will be taxed simultaneously with the US. The tax involved 517 agricultural products. In 2017, the total import from the United States was about 21 billion US dollars, mainly including soybeans, grains, cotton, meat, aquatic products, dairy products, fruits, nuts, whisky and tobacco. Regarding the second batch, China has decided to impose tariffs on about $60 billion of products imported from the United States at four different tax rates: 25%, 20%, 10% and 5%. The second batch of goods on the US tax list involves 387 agricultural products. In 2017, the total import from the US was about US$ 2.9 billion, mainly including hides, vegetable oils, vegetables, coffee and cocoa products, which have covered the vast majority of the first batch of untaxed agricultural products.

At present, the first batch of tax products that China has implemented covers nearly 90% of agricultural products imported from the United States, and agricultural products that the United States exports to China are among them, such as soybeans, grains, cotton, pork and other products. China’s countermeasures were put forward after listening to opinions extensively and carefully evaluating the impact, and they were rational and restrained. As far as China is concerned, the impact of increasing tariffs on agricultural products imported from the United States is very limited because of the diverse import sources and wide import market. In the future, relevant departments will evaluate the effect of countermeasures and strive to minimize the impact of countermeasures on domestic production and life.

Reporter: Among these measures, soybeans are undoubtedly the most concerned. Why has China been importing a large number of American soybeans? Will the soybean import gap caused by countermeasures have a greater impact on China’s edible oil and livestock and poultry breeding industry? What are the countermeasures?

Han Jun: Imported soybeans meet the demand for edible vegetable oil and protein feed. With the improvement of people’s living standards and the development of modern animal husbandry, the demand for edible oil and protein feed in China continues to grow. However, China’s land resources are limited, so it is difficult for us to ensure the basic self-sufficiency of staple foods such as wheat and rice, and at the same time ensure the effective supply of other land-intensive products such as soybeans. At present, the gap between domestic soybean production and demand is more than 90 million tons, which needs to be supplemented by the international market. The United States is the largest soybean producer in the world, with an annual output of more than 100 million tons, but its domestic consumption is limited, and about half of it depends on exporting to the international market.

At present, China’s soybean demand is still increasing, and the trend of large gap between domestic supply and demand will still exist. In 2017, soybean meal accounted for 72.3 million tons of 105 million tons of protein raw materials consumed by feed in China. China takes countermeasures against the United States, and soybean imports from the United States will drop significantly. Some people worry that it may have a certain impact on the supply of edible oil and livestock feed in China in the short term. In order to prevent the linkage effect and increase the pressure of rising domestic food prices, we have made thorough and sufficient preparations. It can be said that China is fully capable of coping with the gap of decreasing soybean imports in the United States. First, actively expand the source of soybean imports; Second, reduce the consumption of soybean meal by adjusting feed formula, reduce the demand for protein raw materials by applying new technology, and increase the import of other oilseeds and meal to make up for the gap of soybean meal; The third is to increase the supply of other edible vegetable oils; The fourth is to improve the soybean support policy and improve the comprehensive production capacity of domestic soybeans.

The impact on American agriculture is predictable.

Reporter: The United States is escalating trade disputes. If the United States insists on imposing tariffs on US$ 200 billion worth of China goods, what does it mean for American agriculture if China strongly opposes it?

Han Jun: My imports from the United States are mainly bulk agricultural products such as soybeans, cotton and pork. On July 6, 2018, the United States announced the implementation of the first round of tariff-added products (US$ 34 billion). As a countermeasure, China imposed a 25% tariff on US$ 34 billion goods, including agricultural products. Affected by the escalation of Sino-US economic and trade frictions, it is foreseeable that American agriculture will be damaged. Although the White House and the Ministry of Agriculture announced that they will implement the agricultural subsidy plan of up to $12 billion, American farmers will still face the risk of losing the China market that they have worked hard for decades.

Soybean is the most important product in Sino-US agricultural trade. In July, the Organization for Economic Cooperation and Development (OECD) predicted that the global soybean supply and demand would be basically balanced in 2018, and the soybean output in the United States would be 117.79 million tons, a decrease of 1.5% over the previous year. From 2015 to 2017, the United States exported 59% of its total soybean exports. Based on this, it is estimated that if there is no trade friction, the US soybean exports to China will be more than 30 million tons in 2018. Since I imposed a 25% tariff on American soybeans on July 6, my company has basically stopped purchasing American soybeans. Beginning in October 2018, American soybeans will be listed one after another, and the impact of China’s tariff increase on imported soybeans from the United States will gradually emerge. The United States will face problems such as falling soybean prices, increasing export pressure, and lengthening export cycle, which will bring losses to American soybean farmers and adversely affect the international trade and industrial development of American soybeans. According to monitoring, since I announced in early April that I intend to impose a 25% tariff on US soybeans, the US soybean futures price has fallen by nearly 20%.

On July 25, 2018, President Trump met with European Commission President Juncker, and a joint statement issued after the meeting stated that the EU agreed to import more American soybeans. In 2017, the EU-28 countries estimated that soybean imports were 13.65 million tons. From 2012 to 2016, the EU imported only 5.5 million tons of soybeans from the United States. According to the forecast of the Organization for Economic Cooperation and Development, the European Union’s soybean imports will be between 13 million tons and 14 million tons in the next 10 years. It is impossible for EU soybeans to be all imported from the United States, even if they are all imported from the United States, it will not solve the problem of tens of millions of tons of American soybeans that should have entered the China market.

The hearing held by the U.S. House of Representatives on July 19 also reflected the concern of people from all walks of life in American agriculture about losing market share. American soybean, grain, dairy products, meat, aquatic products, fruits and nuts have been operating in China for many years before gaining market share in China. The competition in China’s agricultural products market is fierce. If Sino-US economic and trade frictions escalate, American agricultural products will face higher costs in the China market, and their market share will be greatly weakened. Other competitors will not miss the opportunity and will occupy all the market share lost by the United States. If other countries become reliable suppliers to China, it will be difficult for the United States to regain the market. This is exactly what the American agricultural community is most worried about. They don’t want the long-term income to be affected by tariffs.

Actively, steadily and orderly expand agricultural opening to the outside world

Reporter: What is the impact of tariffs imposed by the United States and Canada on China’s agricultural products exported to the United States? How to deal with it?

Han Jun: The catalogue of the first round of products subject to tariff increase (US$ 34 billion) announced by the US on July 6th does not include the agricultural products exported by China. The catalogue of the products subject to the second round of tariff increase (US$ 200 billion) announced by the US on July 10th includes most of our aquatic products and fruit and vegetable products exported to the US.

In terms of aquatic products, the United States is my second largest aquatic product export market. In 2017, my aquatic products exported to the United States accounted for 12.8% and 15.2% of my total aquatic products exports respectively. Aquatic products are the main agricultural products exported to the United States, accounting for 42% of the total agricultural products exported to the United States. The US$ 200 billion commodity list covers all my aquatic products exported to the US. These products are exported to the United States with a high degree of dependence, especially tilapia, shrimp, crab, shellfish and other products. It is difficult to find other alternative markets in the short term and may be affected to some extent. In the next step, the Ministry of Agriculture and Rural Affairs, together with relevant departments, will guide relevant producers to actively explore international alternative markets, strengthen efforts to crack down on smuggling, guide and adjust the structure of breeding varieties, facilitate domestic circulation and sales, expand domestic consumption, and minimize the impact.

In terms of fruit and vegetable products, the United States is the fifth largest vegetable export market and the third largest fruit export market. There are more than 200 kinds of fruit and vegetable products in the list of tariff increase announced by the United States, covering 93% of vegetable products and 99% of fruit products exported to the United States. It is expected that taxation will have a certain impact on the income and employment of relevant fruit farmers and vegetable farmers. However, considering the strong absorption capacity of domestic consumption and the generally lower prices of domestic fruit and vegetable products this year, the actual impact of the US-Canada tariff on the export of our fruit and vegetable products remains to be seen. Next, we will improve the quality of fruit and vegetable products from the production side, enhance market competitiveness and expand the domestic consumer market; At the same time, actively expand the export channels of agricultural products, increase the export promotion of advantageous agricultural products such as fruit and vegetable products, and minimize dependence on the American market.

Reporter: Will China’s agricultural opening-up policy be adjusted in the future?

Han Jun: It has always been the basic policy of China’s agriculture to actively utilize domestic and international resources and markets. China’s agricultural trade is huge, and it has become the world’s largest importer of agricultural products and the second largest trader of agricultural products. At present, China is the largest buyer of agricultural products such as soybeans, sugar and cotton. The development of agricultural products trade has effectively eased the pressure on domestic agricultural resources and environment, and ensured the stable operation of domestic supply and market. At present, the main contradiction of China’s agricultural development has changed from insufficient aggregate to structural contradiction, and it is necessary to accelerate the structural reform of agricultural supply side in deepening reform and expanding opening up. In the future, those who export should try their best to export and those who import should take the initiative to import, which is our clear policy orientation. Agricultural opening to the outside world is the general trend and the correct choice in line with China’s agricultural development direction. We will actively, steadily and orderly expand agricultural opening to the outside world. (Reporter Qiao Jinliang)