Xiangyang Taxi Market: Continuously Revitalizing Vitality in the Reform

In May 2017, urban taxis were replaced with new seat covers

On June 8, 2011, the loving sister Hu Jinyu sent the college entrance examination candidates for free

The first generation taxi Fiat

One of the second-generation taxi models, Fukang

One of the second generation taxi models Van

The third-generation taxi new Elysee

All Media Chief Reporter Li Xinghui Correspondent Hu Jian Intern Huang Wenyan

playback

The first taxi was introduced in 1980

Although the number of private cars is increasing, taxis are still an important means of public transportation in the city. Taxi passenger transportation in Xiangyang began in 1980.

It is understood that that year, Xiangyang City Rental and Public Car Company purchased two Fiat cars for taxi passenger transportation, mainly operating chartered business.

Three years later, the number of taxis in the urban area increased to six. By 1989, the municipal government allowed state-owned, collective and individual taxis to operate in accordance with the development of the national economy. The number of taxis soared to 48, 68 in 1992 and 90 in 1993. However, at this time, the operation mode of taxis was mainly to wait for passengers and charter passengers, and still did not go to the road to pick up passengers.

In 1995, urban taxis were uniformly installed with meters, and began to carry passengers on the road, charging according to the mileage displayed by the meters.

new visit

It has undergone seven major changes

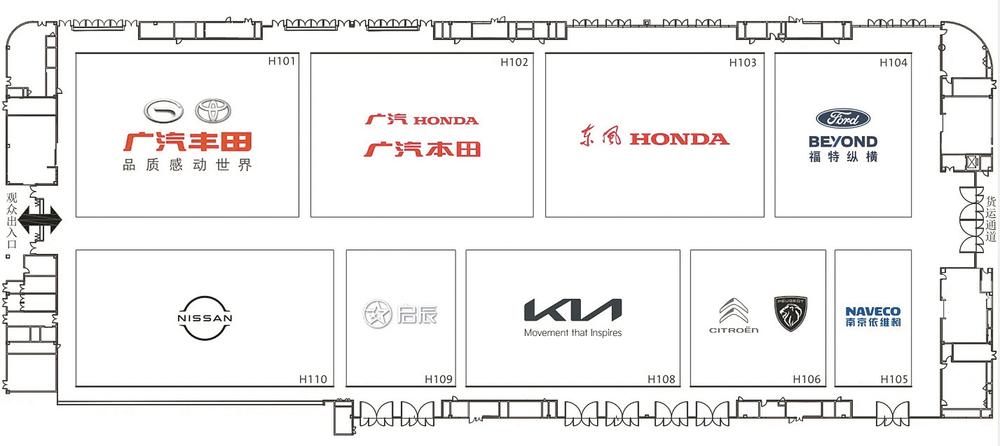

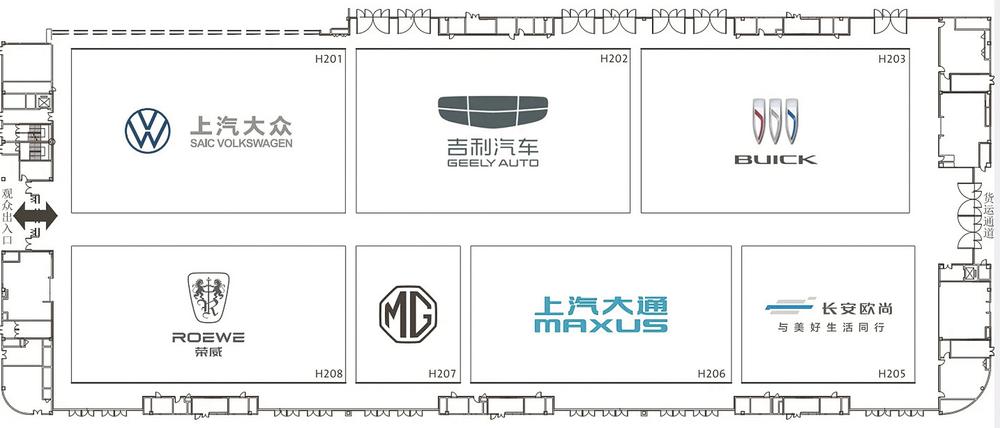

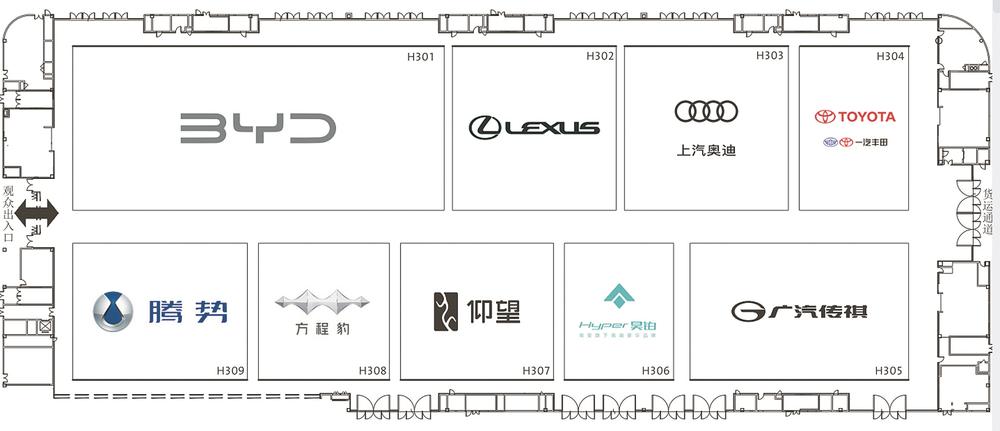

From owning the first taxi to 2018, our city’s taxi market has undergone seven major transformations.

In 1996, Xiangyang City began to implement macro-control on the total number of taxis in the urban area, and implemented the paid use of taxi management rights. In that year, taxis were uniformly replaced with "T" license plates and installed taxi headlights. In 2001, the "T" license plate number segment for urban taxis was uniformly replaced with the "X" license plate segment. There are more than ten types of taxi models such as Alto, Van, and Fukang, and the freight rates are also different.

In 2003, after the original Xiangyang County was removed from the county and set up as a district, the Xiangyang Municipal Government brought the taxis in the original Xiangyang District into the unified management of Xiangyang City. With the approval of the provincial government, Xiangyang City increased the number of taxis by 180, bringing the total to 1,700. In the same year, the municipal government decided to phase out the taxis in three years and replace them all with Fukang cars. On July 6, 2005, the last yellow-faced taxis in Xiangyang City were withdrawn from the market, and all urban taxis were Fukang models. Since August 2008, urban taxis have been gradually replaced by Elysee models.

Since 2006, in response to the impact of rising oil prices on the taxi industry, the Municipal Passenger Management Office has negotiated with the public security vehicle management, price, technical supervision and other departments, and decided to convert the fuel to gas for taxis in the city. In December 2007, the oil-to-gas conversion of taxis in Xiangyang City was completed.

In July 2013, the municipal party committee and municipal government licensed the operation rights of 500 new taxis to the municipal public transportation company, pioneering a new road of "zero docking, zero contracting, zero shift fee, and zero part money" and "public bus" in the country.

In July 2016, according to the "Guiding Opinions of the General Office of the State Council on Deepening Reform and Promoting the Healthy Development of the Taxi Industry", the city started to deepen the reform of the taxi industry. In August of the same year, urban taxis stopped collecting paid transfer fees for operating rights, and cruise taxis officially entered the stage of free use of operating rights. At the same time, the legalization of online car-hailing was quickly started. After a year of preparation, the detailed rules for the implementation of online car-hailing have been revised more than ten times and were officially announced and implemented on December 7, 2017.

On January 26, 2018, our city issued the first online car-booking business license. On March 20, 2018, the first legal online car-hailing car officially went into operation. On September 25, 2018, Xiangyang’s local online car-hailing platform "Xiangyang Travel" APP was officially launched, and Xiangyang’s taxi industry officially entered the era of "cruise + online appointment".

In October 2018, the municipal transportation department integrated the original 23 intensive management companies into three modern cruise car companies with a certain scale, further clarifying the ownership of vehicle property rights, operating rights, and company intensive management rights, and resolving industry contradictions.

Outlook

"Internet + transportation" will bring more convenience

Taxi cars have been available in our city for 39 years.

Over the past 39 years, the urban taxi industry has continued to develop through reform. Today, there are 2,200 urban cruise taxis, 4 cruise taxi companies, about 5,000 employees, a daily operating mileage of 400 kilometers for bicycles, a daily operating income of about 600 yuan, and a daily passenger volume of about 200,000. There are 15 online ride-hailing platform companies, 688 online ride-hailing cars, and nearly 6,000 drivers have applied for online ride-hailing driver licenses.

With the deepening of reform, the operating environment of taxis will continue to improve. The rapid development of "Internet + transportation" will bring more convenience to citizens’ travel.

Witnesses say

Continuously enhance the citizen’s ride experience

In December 1989, at the age of 19, Yang Yongjun joined the Municipal Passenger Transport Management Office, which was established that year, and has been a law enforcement officer for 30 years. "There were only eight people in the entire Passenger Transport Management Office at that time. Now, there are more than 30 people in our three management offices alone," Yang Yongjun said.

Yang Yongjun introduced that Xiangyang’s first taxi company was Oriental Pearl Taxi Company, which was affiliated to the Oriental Chemical Plant and had 10 Alto; after that, Hubei Chemical Fiber Taxi Company and Light Boat Taxi Company entered the taxi market; later, Auto Trade Taxi Company appeared, and the yellow face entered the lives of Xiangyang people. "In the past, we mainly cracked down on illegal operation activities, but now we mainly regulate the business behavior of licensed taxis." Yang Yongjun said that with the development of society, people have more choices when traveling. As a passenger transportation management department, we must ensure that citizens who travel by taxi have a more comfortable and comfortable riding environment, and constantly improve the public’s riding experience.

(Photo courtesy of the Municipal Passenger Transport Administration)