Editor’s Note: This article comes from WeChat WeChat official account’s "Blue Whale Muddy Water" (ID:hunwatermedia), which was published by 36Kr with authorization.

Interview and Writing | Gemee

Content Master Plan | Guo Nan

Live, live, live ……

In 2020, live broadcast seems to be a universal antidote to solve the problem of traffic growth and realization, especially under the impact of the epidemic, all walks of life are generally online or e-commerce.

We have seen more new forms of content consumption, such as Cloud Watch Exhibition, Cloud Music Festival and Yunbengdi. On the other hand, e-commerce live broadcast with fire by Taobao has also ushered in new growth, and content platforms including Aauto Quicker and Tik Tok have gradually increased the realization mode of live broadcast with goods.

After the e-commerce platform with stronger supply chain capability, transaction guarantee and performance ability has occupied a dominant position, live selling has actually solidified into an important shipping channel for the retail industry. After the market cultivation is completed, the fundamentals of both supply and demand sides are stable.

On April 1st, 2020, Luo Yonghao completed his first live broadcast with goods in Tik Tok, and the controversy naturally existed. However, for Luo Yonghao, if more Weibo can be marketed, the high-profile benefits naturally outweigh the hardships.

Sell former friends’ mobile phones, bow down and apologize to the brand, and try razors with goods. ……

No matter how the outside world looks at it, the middle-aged online celebrity’s "re-starting a business" is obviously smoother than before, and he must have more confidence to pay off his debts.

On the same night of Lao Luo’s live broadcast, Viya sold a rocket with a price of 40 million yuan in the Taobao live broadcast room, and Simba’s apprentice "Dan Dan Xiao Pen You" sold a total of 2.78 million items in Aauto Quicker live broadcast, with a total transaction amount exceeding 480 million yuan.

Zhu Guangquan, the host of CCTV, and Li Jiaqi, the anchor of Taobao, partnered with "Xiao Zhu Pei Qi" to bring more than 40 million yuan to Hubei public welfare.

The head anchor is in the limelight, and there are naturally more and more businesses, anchors and MCN institutions that yearn to bring millions of goods once.

Zhaopin’s "Talent Report of Live Broadcasting Industry in Spring 2020" shows that the recruitment demand of live broadcasting industry increased by 132% year-on-year after the Spring Festival. The average monthly salary of Taobao live talent reached 9845 yuan.

In the economic era of online celebrity, e-commerce is an important way to realize cash. It is a natural thing to do some business with influence:

In the general trend, live broadcast will become the standard of e-commerce platform, and content platform will be the standard of e-commerce.

After the "live broadcast fever" faded and the bottleneck of e-commerce growth, the e-commerce platform tried to drive traffic and revenue growth through live broadcast. This is a change from "live broadcast yearning for e-commerce" to "e-commerce yearning for live broadcast".

The problem is that e-commerce is a typical re-investment model, and the industrial chain involved is far more complicated than opening a Taobao store. Where will this platform and MCN continue to increase the live broadcast competition?

This paper will discuss the following issues:

"Either time for traffic or money for traffic."

An e-commerce anchor once introduced his own experience in this way. The platform allocated traffic to the live broadcast room, which can easily open the difference between the viewing volume and sales of the same anchor by ten times.

Pure e-commerce live broadcast actually lacks a fan base, and the traffic distribution on the platform side has a great influence, so online celebrity with its own traffic becomes a natural choice. Deepening cooperation with merchants and brands has also become another value export that MCN has found after content marketing.

Back to the live broadcast room, the core competitiveness of the anchor comes from two aspects, one is that the price is favorable enough, and the other is the professionalism of product selection and promotion.

Among them, the price comparison is dominant and the product selection is invisible. The former is directly related to the instant conversion rate of the live broadcast room, while the latter affects the consumer evaluation, repurchase and even the return rate.

According to the Online Survey Report on Consumer Satisfaction of Live E-commerce Shopping released by China Consumers Association on March 31st, the top four reasons why watching live broadcast turned into shopping were high cost performance (60.1%), favorite products (56.0%), price concessions (53.9%) and limited time concessions (43.8%).

Generally speaking, the main reason to attract consumers to decide to shop is the cost performance and price concessions of the goods themselves.

Among them, 37.3% of the consumers interviewed have encountered consumption problems in live shopping, and consumers’ false propaganda and concerns about the source of goods are relatively prominent.

E-commerce live broadcast is still a form of social promotion, and each live broadcast room can be regarded as a small promotion festival.

The common problems of e-commerce and promotion will also appear intensively on e-commerce live broadcast, such as high return rate and after-sales problems.

Wei Zhe, founder of Jiayu Fund and former president of Alibaba B2B, once said that taking clothing as an example, the return rate of clothing in traditional stores will not exceed 3%, but the return rate of e-commerce is as high as 30%. The return rate of this kind of shopping festival in double 11, and the return rate of live broadcast goods in Li Jiaqi and Viya are far greater than this ratio.

Promotion is actually a kind of centralized shipment. The so-called concentration lies in the concentration of different elements such as time, channel, category, brand and form, which is particularly obvious in Taobao live broadcast:

With the "Matthew effect" in the field of e-commerce live broadcast becoming more and more obvious, the channel value is constantly increasing, and the bargaining power of anchors has also changed. The anchors not only attract users with the "lowest price in the whole network", but also divide the hierarchy by pit fees and commission rates.

There are also some hidden worries about the direct users of consumer goods. For consumers, shopping is the content of life; For merchants, selling goods is a commercial activity; What consumers need is high quality and affordable, and businesses pay more attention to the efficiency of selling goods.

In this scenario, the demands of the two parties have come to a "hard landing" contact after eliminating the traditional "buffer" of contact between supply chain channels, dealer platforms and branded advertisements.

Therefore, most e-commerce live broadcast categories have very serious double-end appeal mismatch, and it is easy to achieve high sales and high volume in the short term, but the long-term cost of mismatch is the loss of brand value and consumer enthusiasm.

On the other hand, the gameplay of low-cost logic itself is limited.

Sunsink e-commerce represented by Pinduoduo and C2M e-commerce represented by Taobao Special Edition are also attracting price-sensitive consumers with replicable and higher efficiency by increasing subsidies and directly connecting factories.

Back in the live broadcast of e-commerce, the merchants who try to "make quick money" by bringing goods through online celebrity have no branding strategy, but can only constantly seek the purchase and transformation of traffic, and the traffic can even be called "lost volume".

It is inevitable that the industry’s general ROI will decrease. At that time, where will the e-commerce live broadcast go?

The key to channel price lies in the right to speak.

"Bringing users to make businesses", e-commerce live broadcast has raised the right to speak of the head anchor (organization) to a very high level. The anchor should give consideration to providing consumers with "low-priced" goods and the growth of its own income, which will inevitably squeeze the surplus of producers, that is, the profits of merchants and brands.

If the merchant’s profit from shipping through the anchor is lower than the commission fee, he will have to face the choice of whether to lose money to buy exposure.

According to the First Financial Report, the person in charge of Puxi E-commerce revealed that the link fee of Li Jiaqi "double 11" was 150,000 that day, accounting for 20%, and they lost three times in cooperation with Li Jiaqi for five times, and even lost 500,000 on the day of Double Eleven.

Only a few big brands can afford to spend money to change the volume of sound, and it does not constitute a long-term strategy.

Luo Yonghao’s statement that "live e-commerce is not a zero-sum game" is a problem that needs to be inferred again.

"The lowest price of the whole network" can be regarded as an alternative "wholesale" (not completely equivalent). The price is determined by supply and demand, while the formation of "wholesale price" is often determined by the game between manufacturers and distributors. Distributors guarantee the shipment volume, thus sharing the risks of manufacturers and reducing the marginal costs of manufacturers, which is the embodiment of channel value.

In traditional retail, "circulation is cost"-goods generally pass through secondary and tertiary wholesalers (distributors) and then to the final terminal retailer, and the intermediate price increase is easy to exceed 50%, or even multiple price increase;

In e-commerce (online retail), "channel is cost"-goods can reach consumers directly from the first-class warehouse, in which the e-commerce platform is drawn and the operating cost of e-commerce still exists, but the agglomeration effect, channel efficiency and price of e-commerce still have advantages compared with traditional retail;

The general e-commerce live broadcast is based on e-commerce, and the channel of live broadcast is continued. When the shipment volume of the live broadcast room is large enough to still cover the marginal cost of goods under the condition of "the lowest price in the whole network", the merchant is profitable.

From the perspective of game theory, "zero-sum game" is not a result for e-commerce live broadcast, but a trend. To understand with Krugman’s "impossible trinity", it is unrealistic to maintain a long-term balance among merchant benefits, anchor/platform benefits and consumer welfare.

In the link of live broadcast with goods, the beneficiaries of merchants’ profits include platforms, institutions, anchors and consumers, and the consumers have the lowest voice. Once the balance between channel efficiency and value is broken, the cost will eventually spread on consumers.

As a shipping channel, live delivery can only focus on pre-selection and product discount, and the anchor team’s binding force on merchants’ performance and after-sales in the later period of the transaction is actually not high.

There are not a few such things. The reason why Li Jiaqi’s "rollover" looks more is that he is the head, and these things happen during the live broadcast and are more easily seen by everyone on social media.

What needs special explanation is that, although there are many so-called phenomena of "county magistrate selling goods live" and farmers carrying goods live, in essence, both Taobao live and Aauto Quicker, Tik Tok and other platforms are based on the e-commerce model.

A very simple truth is that I sell specialty products live in the village head, not to sell to fellow villagers, but to complete the transaction with someone thousands of miles away through a mature e-commerce platform, channels and after-sales system.

Therefore, what the live broadcast needs to measure is whether it can further improve the operational efficiency in the traditional e-commerce model, rather than comparing it with the traditional offline store operation.

Even from the retail point of view, there is a big difference between online and offline sales and consumption. Many business behaviors that changed from offline to online during the epidemic will eventually return to the original track.

Clean out treasure to train, taobao guest, Beijing Zhuntong, etc., as well as brushing and grading (although they are gray products), are all common buying methods. Live delivery is not only a new form of e-commerce agency operation, but also has the function of "buying quantity".

In addition to "small profits but quick turnover", many merchants and brands can also accept "trading at a loss". In this case, more consideration is given to exposure and brand awareness. Fast and large-scale shipment through live broadcast will also help some new products and stores to improve the recommendation weight of e-commerce platforms.

After the rise of e-commerce, in the process of many traditional brands transforming into online channels, there has been a demand for e-commerce to operate on their behalf. In the traditional e-commerce agency operation, how to balance online and offline business is also critical, such as whether online and offline are the same? Is the same paragraph the same price and homogeneity?

For the retail industry, it is a delicate job to maintain the balance of the price system of each channel. After the popularization of e-commerce, all goods can be compared, but "price is not everything", which ultimately determines consumers’ buying behavior, and it is the common effect of different reasons such as differences in consumer goods, urgency and cultural additional attributes.

On the night of the first broadcast in Tik Tok, Luo Yonghao, e-commerce and price comparison platforms launched special zones such as "Lao Luo Live with the same paragraph" and "Lower than Lao Luo". The "lowest price of the whole network" itself is a comparative discount rather than an absolute discount, and the enthusiasm is obvious.

However, it also reflects a problem that has not been solved by live e-commerce. Will the preferential price of live broadcast have an impact on the price system of manufacturers and brands?

On the industrial side, the regular price (price tag) of standardized brands is generally the actual selling price (often seasonal), in addition to discount prices, promotional prices, activity prices, and hook products (special prices).

The regular prices of more commodities, especially those sold online, are generally confusing. For example, in Luckin Coffee, the regular prices and competing products are all against Starbucks, and after 1.8 and 3.8 discounts, they are actually similar to convenience store coffee. So what gradient is Ruixing’s product itself?

From the consumer’s point of view, the only thing that can be evaluated in the end is the terminal channel price, that is, the difference of the "hand-to-hand price", and "where can the buyer have the seller’s essence" will not change.

Looking back at the e-commerce live broadcast, it is a common measure to give special prices to the goods in the live broadcast room through special channels. For many brands, they want to gain exposure and user growth through this "hook product", but there are also many merchants who are purely for the purpose of fast shipment.

Anson, who is engaged in digital marketing, provided a case. Before that, he met a customer of a traditional manufacturer who wanted to transform. They made a brand positioning plan and a launch plan for the customer and provided a set of digital marketing plans. But the customer said: "The brand is useless. Now online celebrity can sell it with goods."

"You don’t need to be a brand, it’s good to be able to sell goods." Many merchants who blindly enter the live broadcast with goods may think so, but without a brand, there will be no premium, and the profit of bringing goods to online celebrity will not go up.

Merchants want to choose anchors, and anchors are also picking brands and goods. The first-line brands have lower commissions, which is also a manifestation of brand premium.

Anson’s customer has his own factory, which does processing for some high-end brands in Europe and America, so he doesn’t understand "why can’t you take it easy and not make a brand?"

There is a saying that live broadcast is a "what you see is what you get" mode. Is this good for the brand?

From the perspective of exposure and brand, the effectiveness of live broadcast also needs to be fully evaluated, and exposure has advantages and disadvantages. Whether in Li Jiaqi, Viya or Lao Luo, the "rollover" brand is often the most widely spread after the live broadcast.

From the perspective of branding, live broadcast is actually not as good as graphic and short video content. As a part of asset management, brand strategy should be a long-term strategy, and the immediacy of live broadcast is contrary to the long-term demand of brand.

For example, people often say "Ins with the same paragraph", "Little Red Book with the same paragraph" and "Tik Tok with the same paragraph". These contents (which are also commodities) can withstand the spread, consumption and reproduction, and finally form cultural and brand recognition. However, the instant nature of live broadcast makes it difficult for them to have the ability of "planting grass" with pictures, texts and short videos.

Of course, Li Jiaqi has also boosted L ‘Oreal, Guerlain and other brands, which is the embodiment of the anchor’s fit with commodities and brands, and is also directly related to the professional ability of the anchor team. The brand needs to spend money on the right anchor for a long time, and it is hard to say that this income is cost-effective.

Selling goods by live broadcast is not omnipotent. Finding a suitable platform, anchor and pricing can make profit from selling goods. Blind pursuit of "live broadcast effect" can’t do a good job in cost control and income evaluation, not necessarily making money, and it is likely to overturn.

On January 9th, 2020, Yujiahui, the parent company of "Royal Nifang", received an inquiry letter from the management department of the Growth Enterprise Market Company of Shenzhen Stock Exchange, asking about its cooperation mode and content with online celebrity anchor, and its influence on the company’s operating performance, and whether there was any situation of exaggerating the influence of cooperation with online celebrity.

Qingyan (Beauty Media) reported that on January 14th, Yujiahui issued an announcement in reply to the inquiry letter, saying that it cooperated with Li Jiaqi Live 47 times, Viya Live more than 30 times, and cooperated with more than 1,500 online celebrity anchors such as Kiki and Lieer Baby in Jie Chen, and the total number of live broadcasts exceeded 8,000.

In the first three quarters of 2018 and the first three quarters of 2019, the sales of products involved in online celebrity anchor cooperation accounted for 0.99% and 4.02% of the company’s operating income respectively.

Yujiahui said that more than 8,000 live broadcasts with goods have not yet constituted the main source of sales and have little impact on the company’s operating performance.

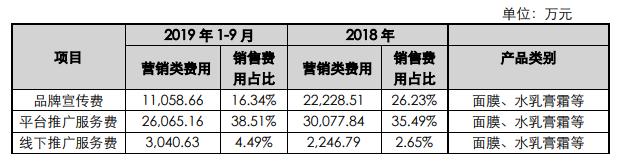

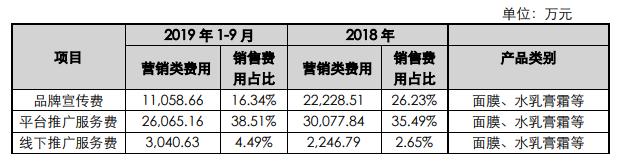

In addition, Yujiahui also announced the proportion of its promotion and sales in 2018 and January-September 2019. Yujiahui’s brand promotion expenses decreased significantly in January-September 2019, but the proportion of platform promotion service fees in sales expenses further increased to 38.51% (35.49% in 2018).

The platform promotion service fee in Yujiahui’s announcement is mainly the commission, technical service fee, promotion service fee or software service fee and rebate paid to the e-commerce platform or the brand promotion service, which shows that Yujiahui still has a high platform promotion expenditure.

The reason why Shenzhen Stock Exchange inquired about Yujiahui was that Yujiahui released the facts about the cooperation with online celebrity to investors, but did not explain the specific impact of the business on the company’s operation. In this regard, the Shenzhen Stock Exchange requires it to explain whether there are situations such as actively catering to market hotspots, speculating the company’s share price, and cooperating with shareholders to reduce their holdings.

It can be seen from the contents of Yujiahui’s announcement that it is a fact to cooperate with online celebrity, and it is also a fact that the level of cooperation with online celebrity is not low and the proportion of sales is not high.

Coincidentally, the storm of live broadcast with goods as an emerging concept in the capital market is not an isolated case.

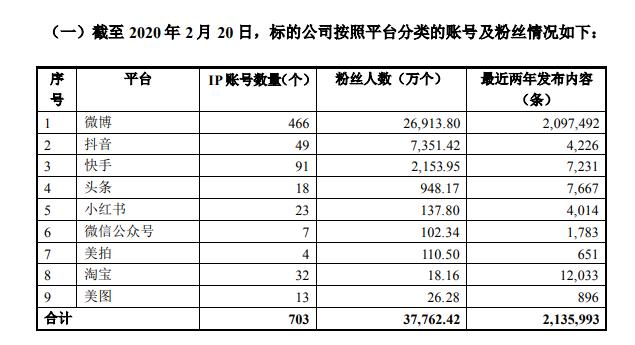

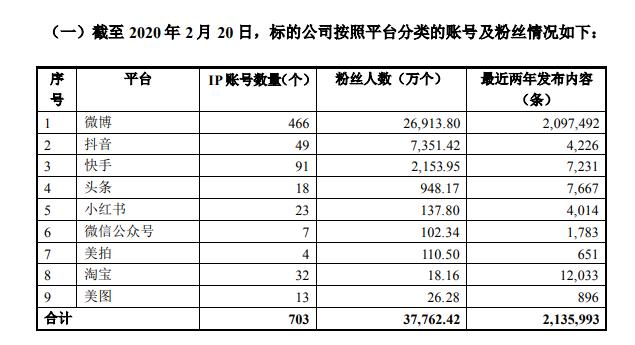

On February 11th, Xiamen Sanwu Internet announced a major asset restructuring announcement, intending to acquire Shanghai Wanrui (Netstar DreamWorks), a MCN company with more than 700 online celebrity IPs and 500 million fans. At present, Shanghai Wanrui has also increased its investment in live broadcast.

After the announcement, the share price of Sanwu Interconnect continued to limit. Later, Sanwu Interconnect received two inquiries from Shenzhen Stock Exchange, and was asked to answer several major questions in the acquisition: whether the disclosure of the plan was prudent, whether there was insider trading, whether the actual controller had a reduction plan, the core competitiveness and going concern ability of the target company, etc.

In the second inquiry letter, the question about Shanghai Wanrui, the target company, is particularly acute:

Please disclose the statistical caliber of "more than 500 million fans", and whether there is "buying fans" and double counting the number of fans;

Please disclose more than 700 online celebrity, and list the number of small and medium-sized incubation online celebrity IP, big coffee online celebrity IP, and head online celebrity IP by classification;

Please disclose the integrated marketing case completed by the target company and the amount of the customer bill;

The Sanwu Internet responded to the inquiry letter of the Shenzhen Stock Exchange and disclosed that Shanghai Haorui’s revenue in 2019 was 120 million; Among the 500 million fans, Weibo fans are 260 million, and the active fans of the company’s Weibo account account account only account for 12.61%, which is about 32.78 million.

Regarding the statistical caliber of "more than 500 million fans" in the inquiry letter, Shanghai Wanrui denied the situation of "buying fans" and admitted the problem of double counting. The double counting mainly includes that a fan pays attention to the same online celebrity on multiple platforms and multiple online celebrity IPS on the same platform are paid attention to by the same fan.

It is impossible to effectively count the data of fans. This problem is actually a common problem in the whole field of online marketing and MCN. Especially for the form of live delivery, which emphasizes the purchase and transformation, there is still a lack of transparency about the net value of customers brought by fans.

In recent years, online celebrity and MCN-related concept stocks have experienced capital speculation, and they are also faced with doubts about their business models in the capital market.

After Ruhan Holdings went public, although it is trying to cultivate new head celebrities, more than 50% of the company’s revenue is still created by Zhang Dayi alone; Mei ONE relies on Li Jiaqi, Qian Xun relies on Viya, and it is a common disease in the industry to rely on head talents.

After being inquired about the acquisition case, Sanwu Interconnect also received warning letters from Xiamen Securities Regulatory Commission to its controlling shareholder and actual controller, letters of concern from the Growth Enterprise Market of Shenzhen Stock Exchange, and public condemnation of its controlling shareholder and chairman for alleged violations.

The process that Sanwu Internet wants to acquire Shanghai Wanrui will be difficult to smooth.

On the other hand, live delivery, which relies more on the trust relationship between anchors and fans, needs to cultivate a new business model with stable user base, and also needs to answer the question of industry standardization and large-scale growth.

As a form of e-commerce agency operation, live delivery should return to live delivery to measure its value.

As we said before, live broadcast is just a tool, and the field it builds depends on the existing identities of the recipients at both ends of the screen and the field characteristics of the live broadcast platform.

In the field of live broadcast with goods, anchors and consumers are the main recipients at both ends of this field. No matter whether the live broadcast room is poor, teasing dogs or talking cross talk, it will finally return to a series of problems such as product price, quality and after-sales.

So, how to understand the value of live broadcast as a tool?

Baharat Anand quoted Craig Mo Feite’s "Dumb Tube Paradox" in the fuse to discuss the pipeline role played by cable TV companies in the streaming media era. The image metaphor of "pipeline" can also be used to understand the value of live broadcast.

The paradox of "dumb tube" reveals the reality that American cable TV service providers, under the impact of the Internet, have abandoned their content lines and transformed into information infrastructure providers, and have also fundamentally changed their existence value in the digital age, so they will not be stifled by the rise of online media.

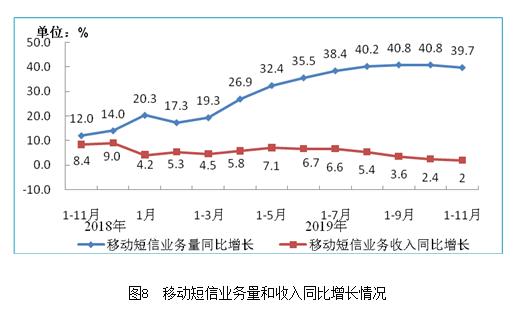

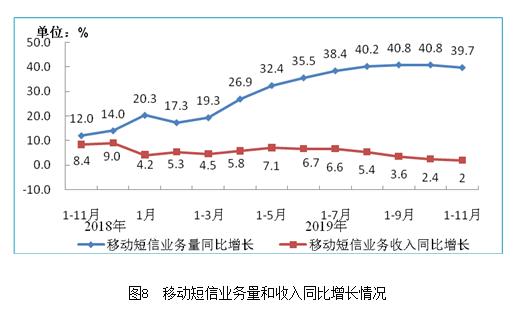

The domestic example is the communication service providers represented by the three major operators. Traditional communication services such as telephone and SMS have been increasingly replaced by network communication software, but as infrastructure providers, operators’ income has been increasing.

According to the data of the Ministry of Industry and Information Technology, the growth rate of telecom business revenue still increased steadily from January to November in 2019, and the telecom business revenue totaled 1,203.9 billion yuan, up 0.5% year-on-year, and the growth rate increased steadily. Looking at the operators’ income again, the operating income of China Mobile in 2019 was 745.9 billion yuan, that of China Unicom in 2019 was 290.51 billion yuan, and that of China Telecom in 2019 was 375.734 billion yuan.

Correspondingly, Alibaba Group’s revenue in fiscal year 2019 (April 2018 to March 2019) was 376.844 billion yuan, and Tencent’s annual revenue in 2019 was 377.289 billion yuan.

Only from the perspective of revenue, the two giants of the Internet can add up to be comparable to an operator of China Mobile.

Even though many people have long lost the habit of texting, during the period from January to November 2019, the revenue of domestic mobile SMS business still reached 35.8 billion yuan, a year-on-year increase of 2%.

If Internet companies such as Tencent and Ali are cars, communication service providers are the way. This is the value of the pipeline, which is the embodiment of the "channel is king" in the communication industry.

For Internet platforms such as Taobao, Tik Tok and Aauto Quicker, the principle of pipeline value also applies.

What the platform needs to take into account is the growth of its entire traffic market. It is a very realistic stage growth strategy to encourage short videos when short videos are on fire and stimulate live broadcasts when live broadcasts are on fire.

As far as the field of live broadcast is concerned, an obvious problem is that although the platform side has said a lot to encourage the development of the industry and issued a lot of policies, it is still a few head anchors.

It is enough for the platform to stimulate the participation enthusiasm of the industry through the demonstration effect of the head anchor.

Another question worth thinking about is, will the platform really spare no effort to support live delivery?

The live e-commerce research report of China Merchants Securities pointed out that the essence of live e-commerce is the embodiment of the brand’s desire for private domain traffic. The research report also believes that live e-commerce reshapes the people’s goods yard: 1. People change from active consumption to passive consumption; 2, the goods go to middlemen, and the origin of the products is brought closer; 3. The function of "clairvoyance+clairvoyance" has become a reality.

In 2017, after Jack Ma put forward the concept of "new retail", Zhang Yong, then CEO of Alibaba, continued to interpret the new retail from the concept of "people, goods and fields", pointing out that the key is the reconstruction of all commercial elements and the efficiency improvement brought by element reconstruction.

In the following years, the theory of "people’s goods yard" continued to be widely used in the retail and consumption fields, such as social e-commerce, community group buying, fresh e-commerce and other fields, and even appeared in smart homes, e-cigarettes and other industries.

In the meantime, the theory of "people’s goods yard" has undergone obvious marketing conceptualization, from the relatively complex and macro level of new retail, to more vertical fields and industries, and even to a specific product and function, and at the same time, it emphasizes methodology and quick results.

It can realize a live broadcast of e-commerce with over 10 million goods and over 100 million goods, which seems to perfectly fit the efficiency improvement of the so-called "people and goods yard" reconstruction. However, can the considerable sales ability of an anchor and a live broadcast with goods really verify the "people’s freight yard" theory?

Looking back at the retail industry, there are still too many uncertainties about whether the scale, stability and controllable efficiency necessary for factor reconstruction can be popularized and verified in the industry for a long time:

As we mentioned above, the live broadcast has a head effect and goes further; For another example, even for the head MCN, the research report of China Merchants Securities also said that such institutions are currently small, and their business models and profitability have yet to be verified.

In recent years, whether it is new retail or social e-commerce, the mode innovation of the so-called "people’s goods yard" often falls on the innovation and change of consumption scenes.

In the evolution of consumption scenarios, we can use the concepts of online celebrity economy, sinking market and private domain in recent years to establish a simple analysis framework to further discuss the e-commerce live broadcast:

As we all know, Li Jiaqi was a BA (Beauty Consultant for Cosmetics Counter) of L ‘Oré al in his early years and won the sales champion. At the end of 2016, MCN Institutional Beauty ONE cooperated with L ‘Oré al Group in the Taobao live broadcast project of "BA online celebrity". After Li Jiaqi entered the competition, she signed Beauty ONE to become a beauty expert. Since then, she has accumulated a large number of fans in Taobao live broadcast. After selling lipstick with Jack Ma "PK" in double 11 in 2018, "Lipstick One Brother" has gradually come out of the circle.

Has Li Jiaqi proved the success of the project of "BA online celebrity"?

As of March 29, 2020, the Taobao list shows that the Taobao Live Talent Index ranks in the top 100, and the signing talents of US ONE are only Li Jiaqi and Hu Yueming _demi; In addition, as early as February 2018, Hu Yueming _demi’s Taobao fans reached 850,000. At present, she ranks 18th on the list of people with just over 1.15 million Taobao fans.

There are various accidental and inevitable factors for Li Jiaqi’s popularity. "BA online celebrity" is an opportunity for Li Jiaqi, but the project itself is far from success. It can even be said that Li Jiaqi is an accident of this project, and until now, US ONE still relies too much on Li Jiaqi.

The modest search of the first list of Taobao institutions reflects the other side of e-commerce live broadcast in the operation of Daren:

Although it is not as out of the circle as Li Jiaqi, Viya is still another peak in Taobao anchor, including the accumulation of long-term offline retail and online stores in Viya, and the help of institutionalized operation after the establishment of Qianxun.

In the same period, Taobao Live Talent Index ranked in the top 100, and 14 talents were Qianxun’s artists. Besides Viya, Qianxun was more active in signing talents, such as famous beauty bloggers such as late-night xu teacher and Zhang Mofan, and online celebrity.

Qianxun’s strategy of signing a top talent is in line with the natural trend of "BA-ization in online celebrity" after the outbreak of e-commerce live broadcast, that is, more and more online celebrity and stars with voice want to enter this industry.

This also reflects that MCN institutions such as Midea ONE, Qianxun, Ruhan and Worry-Free still can’t realize the vision of "cultivating online celebrity in batches". In terms of the incubation and liquidity of online celebrity, MCN institutions have hardly changed or improved in recent years.

MCN itself has become a outlet by outlet. Whether it is a content production organization or a service provider with content marketing as its core is a "strange circle" that MCN has not walked out of.

When it comes to online celebrity, Aauto Quicker and Tik Tok, as important platforms for live broadcast of goods in online celebrity, have obvious differences from Taobao live broadcast.

According to the data of China Merchants Securities, the daily average transaction volume of live broadcast goods in Aauto Quicker in 2019 is 100 million, and it is expected to be 40-50 billion for the whole year; Everbright Securities predicts that the narrow-caliber transaction scale of Aauto Quicker live broadcast will be 25 billion (the transaction scale within the platform) and 150 billion (the transaction scale led by the anchor to WeChat).

The limelight of Aauto Quicker live broadcast is not so much the emergence of "e-commerce live broadcast" as the exposure of Aauto Quicker live broadcast itself.

Aauto Quicker’s long-term accumulation of users in the sinking market, anchor trust foundation and live broadcast selling habits are the basis for Aauto Quicker to become the second platform for live broadcast.

As for the sinking market, we have said in previous reports that the "Internet going to the countryside" represented by the sinking market is actually a continuation of the "information equality" movement, and the greatest significance lies in the reconstruction of information elements. Third-and fourth-tier cities, small towns and vast rural markets are related to more intertwined channels, interpersonal patterns and differences in consumption concepts, but they are fundamentally urbanization problems.

From the perspective of urbanization, the sinking market and private domain are actually highly compatible:

Due to the more thorough transformation of commercial culture, cities have typical characteristics of consistent consumer culture, such as consumer brands such as Haidilao and Xicha, and commercial real estate brands such as Vanke Center and wanda plaza, which are very popular in first-and second-tier cities, and even in some third-and fourth-tier cities.

In small towns, rural areas and other areas, the more traditional business model is still very competitive. Even online car rental and take-out services with prominent Internet platform may not compete with local car rental and take-out services in these areas. As for the differences of consumer brands, from the early store sinking strategy of vivo and OPPO, the traditional dealer stores such as VIP Bird and Elcon operated in franchise mode, and the brand recognition in the sinking market was also high.

Another example is that some special fields and specialized services are based on the different needs of different markets, which is the embodiment of the "ten miles of different sounds" in the consumer field.

To put it simply, the difference in lifestyle between first-line and second-line residents is far less than that between county towns and rural areas. Urban culture is consistent, so online celebrity stores can be opened all over the country; Sinking market, city, town and village, each level is a layer, and consumer goods are very different.

The popularity of the term "sinking market" appeared around the time of listing in Pinduoduo, and the term "sinking big three" also appeared. By the end of 2019, the saying of sinking the market was more replaced by private domain.

Because the whole sinking market, in fact, is a collection of countless small private areas, with the characteristics of mutual connection and division. There is a sinking market, but the sinking market is not a big market.

In 2019, Aauto Quicker made great efforts to enter the first and second tier, and Tik Tok adopted a sinking strategy to break down the so-called "inside and outside the Five Rings" based on information services. The actual effect is actually drawing to a close.

Looking back at live delivery, the reason why "online celebrity BA" will become the mainstream is because online celebrity is a shortcut to private domain.

However, online celebrity’s popularity and consumer trust are based on long-term content and social maintenance, and it is not really possible to maintain a good popularity by bringing goods. The artistry of Li Jiaqi is also an example.

With regard to e-commerce live broadcast, the stakeholders, business model and retail reform involved are a very complicated and unsystematic issue. This article is not complete, and there are still many problems that have not been included, such as:

The following are some fragmented thoughts, but I think they have certain reference value:

1, whether Taobao or Tik Tok Aauto Quicker live broadcast with goods, can not break through their own platform positioning. It can be inferred that Aauto Quicker live delivery will encourage self-built and external e-commerce modes, and at the same time strengthen advertising share; Tik Tok’s short video marketing is stronger than live broadcast, and it is still an advertising growth strategy for a long time; Taobao live APP must rely on Taobao’s continuous diversion, and it is difficult to make a separate consumption platform, but it can be made into a tool.

2, Taobao data, about half of merchants have used Taobao live broadcast to sell goods. From an operational point of view, gradually improving the form of self-broadcast by merchants will become an important means to balance costs and operational growth.

In fact, whether it’s live broadcast of Taobao or live broadcast of other content platforms and brands, this kind of "de-online celebrity" live broadcast sales has become more common. From the point of view of employment, the sales model of shop assistants going to online celebrity is traditional BA online, and the ceiling is not very high, but it is sustainable.

In addition, don’t be too superstitious about the effect of live broadcast with goods. taobao guest, Taobao Alliance, Beijing Zhuntong, etc. still have good channel effects, and even lead WeChat and small programs to make deals. The key is cost control and comprehensive efficiency improvement.

3, based on the differences in urbanization, lifestyle and popular culture, the impact on the consumption field can not be ignored. Even in the city, since there are constantly business and brand innovations hidden, such as Modern China Tea Shop, which has not yet left Changsha. The birth and development of a new consumer brand should bring vitality to the consumer market and enrich our urban culture.

4. The efficiency of e-commerce live broadcast matching people’s freight yard should be evaluated on the basis of e-commerce. Many industries in the current epidemic stage are online, which is a last resort. We are still waiting for an opportunity to return to the offline consumption space, not for "retaliatory consumption" but for a more real life.

5, the low-cost strategy of e-commerce live broadcast is hidden in the connotation of promotion, so it is difficult to change. Platform-led low-cost, the other end is C2M, but it is difficult to get through the C2M model.

In the not-too-long history of retail development, "factory goods" often refer to "tail goods" (the sound of factory closure in Wenzhou, Zhejiang Province is still there). C2M still needs to be verified by consumer culture, which may lead to the differentiation of consumer groups and categories.

For example, clothing C2M is basically difficult to make, even if it is a basic model, different brands have their own connotations; Another example is Uniqlo’s stolen joint money. Consumption is not only a purchase, but also a kind of self-expression.

From this point of view, C2M may not be as good as OEM, ODM and OBM’s pseudo-factory model.

6, two fundamentals of consumer business, one is manufacturing, and the other is retail. The innovation of retail model is inseparable from the progress of manufacturing industry. Only a more efficient and benign development of manufacturing industry can bring real consumer surplus.

"Consumer surplus is an important indicator to measure consumer welfare."

References:

"The little red book of 250 million users began to broadcast live-e-commerce temptation? Or content anxiety? Blue Whale Muddy Water June 21, 2019

Farewell to 2010s, Past and Future of "Traffic Commerce" Blue Whale Muddy Water December 24, 2019

"Eleven Years Changed by double 11" Blue Whale Muddy Water November November 2019

China Merchants Securities: Live E-commerce Kill in Three Kingdoms, from "Cats Fighting Dogs" to "Cats Shaking Fast" China Merchants Securities 2020.01.05

"Li Jiaqi, Viya with goods in the end? Yujiahui handed over the answer to Shenzhen Stock Exchange.

Tik Tok is restricting online celebrity’s goods-carrying behavior, which is an inevitable choice. Internet and entertainment thieves group January 23, 2020.