Meituan VS Ele.me, much more than takeout

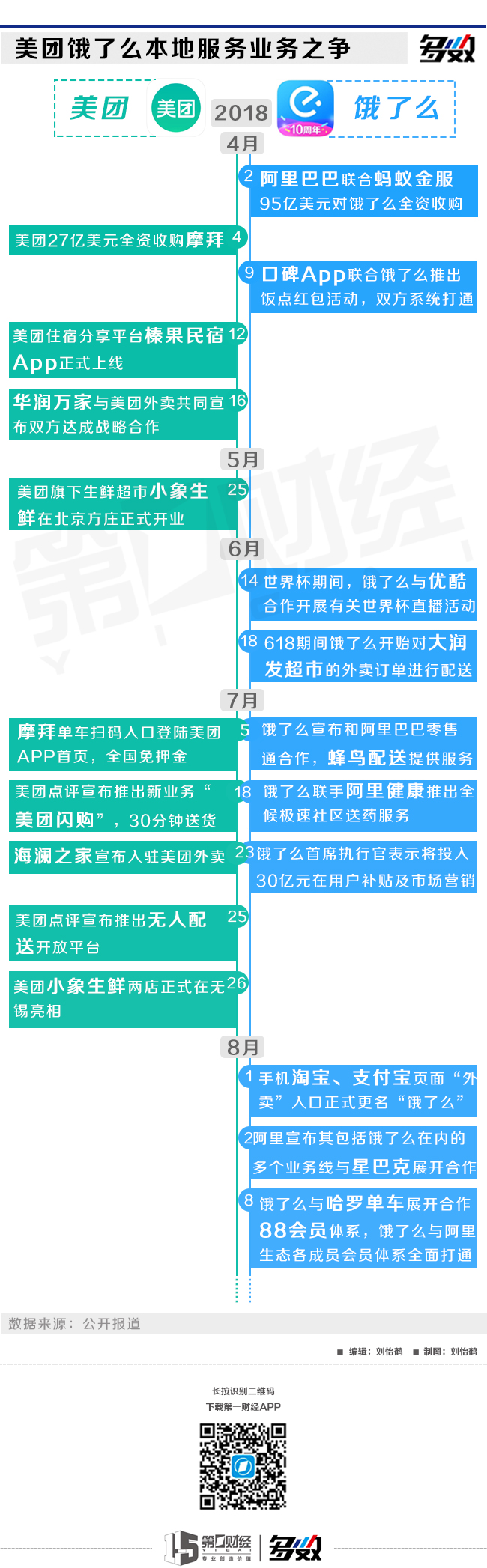

Recently, on the 10th anniversary of Ele.me, Ele.me, which was put into Alibaba’s arms in April this year, has made full use of Alibaba’s funds and resources to launch a series of activities to accelerate business expansion and market capture. In fact, although the competition between Meituan and Ele.me originated from food delivery, the war has already spread to a broader local service business. On the one hand, Meituan Dianping, which is fully fledged and is about to go public, and on the other hand, Ele.me, which is connected with Alibaba’s system, who will be better?

Takeaway old things, Ali’s thoughts

According to the data of 17 years and the first half of 18 years, Meituan is a well-deserved leader in terms of transaction volume and user platform distribution. Even though Ele.me acquired Baidu takeaway in August last year, it is still inferior to Meituan, which has more than half of the market share. However, the takeaway market, which originally thought that the pattern had been set, has made a comeback with Ele.me’s defection to Ali Langyan. The takeaway business is the largest local life service entrance, which is not only Meituan’s main business but also the strategic support point for Ali’s layout of new retail. In fact, there has always been a shadow of Ali’s capital in Meituan’s initial financing, but Meituan was dissatisfied with Ali’s strength and control. Ali also lost patience with Meituan’s wavering between Tencent and Ali, and the two sides eventually parted ways. Now Alibaba is spearheading Ele.me, investing 3 billion yuan this summer to achieve the short-term goal of raising Ele.me’s market share to 50%. In the opinion of Ele.me CEO Wang Lei, Alibaba’s battle of living locally is "impossible to lose", which also means that Alibaba will invest huge funds and resources in Ele.me.

The ecological closure of the largest unicorn

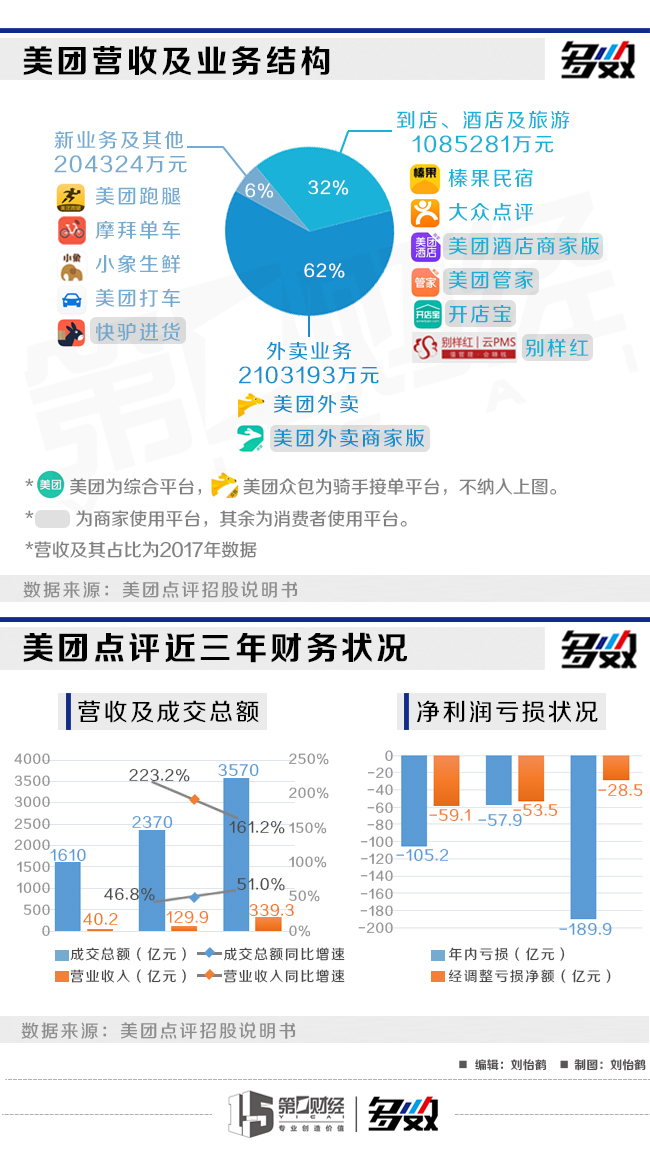

In the "2017 China Unicorn Enterprise Ranking", Meituan Dianping ranked first in the e-commerce industry with a valuation of 30 billion US dollars. After Meituan Dianping officially submitted the prospectus to the Hong Kong Stock Exchange on June 25 this year, its valuation was as high as 60 billion US dollars. Meituan Dianping has built a one-stop comprehensive life service platform to connect merchants and consumers, creating a "merchant + service + consumer" ecological closed loop. Its business coverage is beyond the reach of other competitors. According to Meituan Dianping’s prospectus, food delivery, in-store catering, and hotel tourism are the company’s main businesses, contributing more than 90% of its revenue and gross profit. At the same time, Meituan Dianping has launched new businesses such as fresh food, online car-hailing, and merchant services this year, continuously improving the local service system and building ecological barriers.

From a financial point of view, Meituan comments on the one hand, the rapid expansion of revenue, benefiting from the number of users, transaction frequency, flow rate, as well as new business development, brand influence and other factors, in 2017 the company’s gross merchandise volume and operating income reached 357 billion yuan and 33.93 billion yuan, revenue growth rate of 161.2% exceeded the gross merchandise volume growth rate of 51.0%. On the other hand, Meituan losses continue to narrow. According to the prospectus, from 2015 – 5.91 billion yuan narrowed to 2016 – 5.35 billion yuan, 2017 further narrowed to – 2.85 billion yuan, loss halved within 3 years. It is worth mentioning here that, like companies such as Xiaomi and Meitu listed in Hong Kong before, Meituan also has "non-operating losses" due to the increase in the fair value of "convertible redeemable preference shares" issued to shareholders in past financing. Therefore, after excluding the special accounting treatment related to the above, the "adjusted net loss" is more valuable.

Close combat, local service will eventually die?

Ali has been punching frequently since its acquisition of Ele.me, and it has accelerated its action after Meituan Dianping submitted its prospectus. Although Meituan Dianping stands behind the major shareholder Tencent, Tencent is more like an investor than a controller, and there is no deep cooperation or connection between the companies it invests in. Therefore, the current competition landscape is Meituan’s ecological closed-loop against the deep integration of Ali + Ele.me. The two sides have gone head-to-head in various fields, Meituan takeaway and Ele.me in the field of catering takeaway, Dianping and word-of-mouth in life information, in-store catering, and baby elephant fresh and Hema Fresh in fresh new retail. Through the timeline of the expansion of the local service business of both parties, it is not difficult to see that many of the new businesses are still small in size, and many of the cooperation and opening up have just begun, and the market share will still change.

The author of this article: Liu Yihe (intern)